Solo | Individual 401k

Unlock greater retirement savings potential with the Solo 401k, tailored for the unique needs of business owners without employees.

What is a Solo 401(k)

A Solo 401(k) is a tax-efficient retirement plan designed specifically for self-employed individuals and small business owners without employees. This unique retirement option provides an opportunity for substantial contributions, giving you the freedom to maximize your retirement savings.

By having both employer and employee contributions, it allows for enhanced tax benefits and an expedited path to achieving your retirement goals.

In essence, a Solo 401(k) isn’t just about creating a retirement nest egg; it’s an investment in your financial well-being and a strategic financial move that can have lasting benefits for your future.

Contribution Limits:

- Employee contributions up to $22,500 for 2023, and $23,000 for 2024.

- Total employee & employer contributions totalling up to $69,000.

- An additional $7,500 catch-up contribution for business owners age 50 and older.

- Solo 401(k)s support both Roth and pre-tax contributions.

Eligibility:

- Self-employment: You must be self-employed, either as a sole proprietor or as a business owner with no employees other than a spouse (who is also eligible to participate).

- Solo Status: The plan is intended for individuals without full-time employees.

- Taxable Income: You need to have earned self-employment income to be eligible for a Solo 401(k).

Let’s Start

With A Proposal

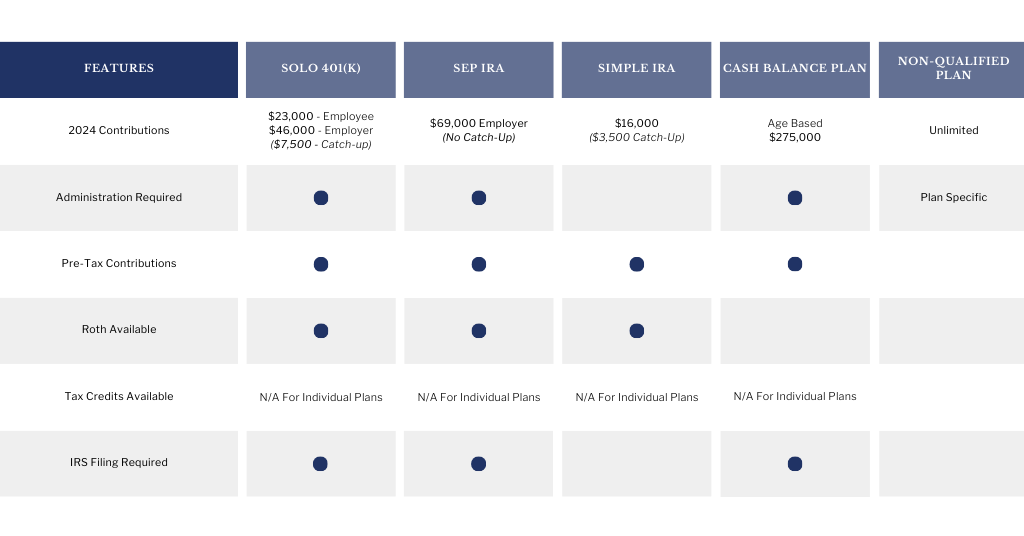

Compare to other individual plan options.

See how the Solo/Individual 401(k) stacks up to other options for business owners without employees.

Who Should Consider a Solo 401(k).

Self-Employed Individuals Seeking Maximum Contributions.

For the self-employed professional interested in saving as much as possible for retirement, the Solo 401(k) offers remarkably high contribution limits. This plan allows you to contribute both as an employer and an employee, dramatically increasing the amount you can save.

Key Advantages:

- Enables large contributions from both employer and employee sides.

- Flexible investment options suited for those who want to self-direct their retirement funds.

Business Owners with Sporadic Income.

If your income varies from year to year, the Solo 401(k) gives you the flexibility to adjust your contributions accordingly. This can be a significant benefit for freelancers, consultants, or anyone with an inconsistent income stream.

Key Benefits:

- Allows flexible contributions, accommodating fluctuating incomes.

- Potentially reduces taxable income, offering tax advantages.

Spouses Running a Family Business.

If you and your spouse are the sole operators of your business, a Solo 401(k) can be an ideal retirement solution. It enables both of you to make generous contributions, effectively doubling the family’s retirement savings potential.

Important Considerations:

- Makes spousal inclusion straightforward, maximizing family retirement savings.

- Offers loan features, providing liquidity in case of emergency.

.

Some Of Our Trusted Partners:

Other Plans To Consider

Consider exploring alternative plan options that could also suit your needs, in addition to the Solo 401k.

Commonly Paired

Cash Balance Plan

Optimize contributions with a plan that allows for higher contribution limits, ideal for high income business owners.

SEP IRA

Select a plan with high contribution limits and minimal administration, ideal for self-employed and small businesses.

Simple IRA

Opt for a hassle-free plan that minimizes administration, ideal for small businesses looking for simplicity and ease.