SEP IRA

Streamline Your Retirement Savings with SEP IRAs: Tailored Solutions for Small Businesses

What is a SEP IRA?

A Simplified Employee Pension Individual Retirement Account (SEP IRA) is a tax-advantaged retirement plan tailored for self-employed individuals and small business owners.

This retirement option combines simplicity and flexibility, allowing substantial contributions to secure your financial future.

Whether you’re a sole proprietor, freelancer, or business owner, the SEP IRA offers an efficient way to save for retirement and potentially reduce your taxable income. It provides a valuable retirement solution that benefits both you and any eligible employees.

In essence, a SEP IRA is not just a retirement account; it’s a strategic financial tool that paves the way for secure financial future, both for you and your employees if applicable.

Contribution Limits:

- Contributions of up to 25% of your compensation or $66,000 for 2023 and $69,000 for 2024, whichever is less.

- Roth Contributions allowed starting in 2023.

- Easy contribution process without administration needed.

Eligibility:

- Open to self-employed individuals, small business owners, and those with freelance income.

- Ideal for businesses with little to no employees, offering a retirement solution for both employers and employees.

- No strict solo status requirement; you can have employees and still benefit from a SEP IRA.

Let’s Start

With A Proposal

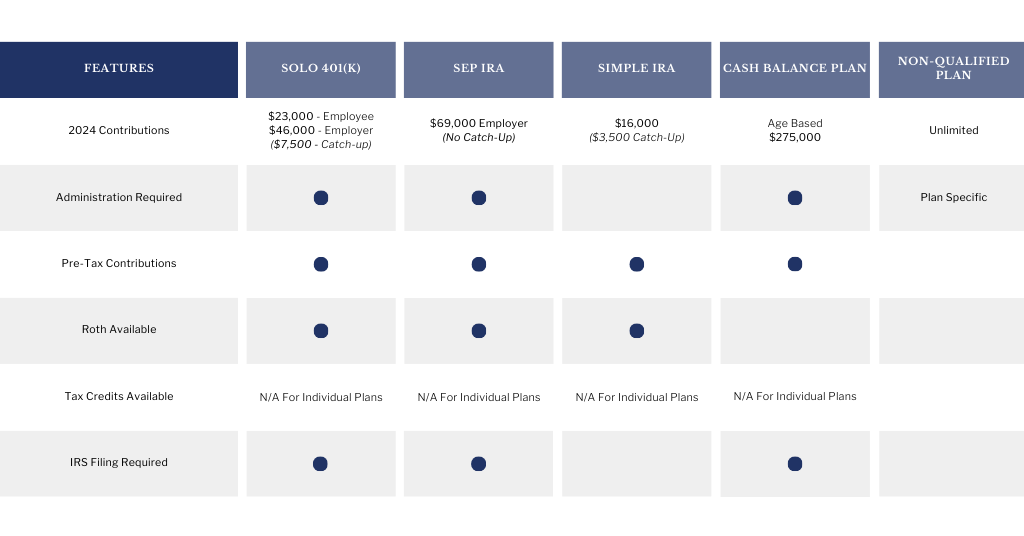

Compare to other individual plan options.

See how the SEP IRA stacks up to other options for business owners without employees.

Who Should Consider a SEP IRA.

Business Owners with Consistently High Income.

For business owners with a track record of consistently high income, a SEP IRA can be an ideal retirement plan. With contribution limits tied to your income without the ability for employee contributions, those earning more can maximize their retirement savings effectively.

Key Considerations:

- Ideal for individuals with stable high income.

- Allows substantial contributions in years of financial success.

Part-Time Entrepreneurs and Side Hustlers.

Even if you have a full-time job and run a side business or freelance, a SEP IRA offers an excellent retirement solution. It lets you maximize your retirement contributions and potentially reduce taxable income from your additional income stream.

Benefits:

- Suitable for individuals juggling full-time jobs and side businesses.

- Offers a valuable tax-advantaged retirement account for additional income.

Freelancers and Gig Economy Workers.

Freelancers and gig economy workers often face fluctuating incomes. A SEP IRA caters to their changing financial circumstances, allowing them to save more during prosperous months and adapt contributions during leaner periods.

Key Advantages:

- Offers flexible contributions based on variable income.

- A simplified retirement savings option for independent workers.

Some Of Our Trusted Partners:

Other Plans To Consider

Consider exploring alternative plan options that could also suit your needs, in addition to the SEP IRA.

Most Popular

Solo 401(k)

Maximize your contributions with both employee and employer contributions for business owners without employees.

Advanced Strategy

Cash Balance Plan

Optimize contributions with a plan that allows for higher contribution limits, ideal for high income business owners.

Non-Qualified

Select a plan for targeted benefits to specific employees, offering added flexibility.